Cpgconnect // Vol. 26: Target Takeovers, Protein Everywhere, and the 2026 Shift

We’re back. It’s 2026, and I couldn’t be more excited to kick things off with you. I hope everyone had a great holiday break and is feeling recharged heading into the new year. A lot happened over the last couple weeks of December and even into this past week, so this edition is all about getting everyone caught up. We’ve got some really exciting things coming up with Cpgconnect this year, and I’m fired up for where this community is headed. As you read through, make sure to check out the links and take a second to fill out the form so I can keep shaping this into the most useful weekly resource possible.

Appreciate you all, and hope you enjoy this one.

But before we dive in, take a quick second to fill out this form. It helps me give back to the CPG community we’re building, connect the right people, and surface new opportunities for brands looking to grow.

Brand Shoutout: Stacked

Stacked is a performance-first hydration brand built for people who train hard and want more than just electrolytes. Their powdered hydration mixes combine electrolytes with functional performance ingredients like creatine, BCAAs, and betaine to support strength, endurance, and recovery in one simple stick. No fillers, no artificial junk, just clean, multi-functional hydration designed for real training days.

Tech Shoutout: Peasy

If your inventory is spread across files named “FINAL_v6_FIXED.xlsx,” you already know how fragile most inventory setups really are.

Peasy is one of the most thoughtful inventory tools we’ve come across. It replaces spreadsheet chaos with a single, structured system that mirrors how inventory actually moves in the real world: purchasing, receiving, producing, selling, and counting.

No bloated ERP. No unnecessary complexity.

Built by Bryan, a former mustard brand founder and operator, Peasy is designed specifically for scrappy CPG brands that want tighter operations without slowing the business down.

It’s free to get started, and you can be up and running in an evening. Check it out or book time with Bryan to see how it works in practice.

Events:

RSVP - SmarterSips: NRF Welcome Hour Presented By Klaviyo (Nyc) 1/11

RSVP - Lady CPG dinner party (Sd) 1/11

RSVP - Glimpse x Cultivar CPG dinner (Sd) 1/11

RSVP - Running to the Next Stage 5KM, Hosted by Teifi Digital, Tapcart & Shopify (Nyc) 1/12

RSVP - Consumer Brews with Sumeet Shah, Mike Gelb, and Merry Nebiyu (Nyc) 1/12

RSVP - NRF Happy Hour at the Lunar Solar Group office, hosted with Okendo (Nyc) 1/12

RSVP - CPG After Hours: SD Edition (Sd) 1/12

RSVP - NRF Run Club (Nyc) 1/13

RSVP - NRF Social + Expert Discussion: TikTok, Amazon, & Lunar Solar Group (Nyc) 1/13

RSVP - NRF After Party (Nyc) 1/13

RSVP - UGLY TALK: 2025 LEARNINGS & 2026 PRIORITIES IN D2C & CPG (Nyc) 1/14

RSVP - DTC Dinner in LA (WeHo) 1/21

RSVP - SLC DTC Dinner 1/22

RSVP - Glimpse x Rho CPG Dinner (Nyc) 1/22

Unwrapped w/ Jack Joseph from Drink Rmbr

I sat down with Jack Joseph, founder of Drink Rmbr, to unpack the real story behind building a kombucha brand from a closet setup to meaningful retail traction.

Jack’s path into CPG wasn’t obvious. With a background in supply chain and entrepreneurship from Michigan State, the spark for Drink Rmbr came through a personal health journey and the influence of his brother, who transformed his life through sobriety and intentional consumption. That mindset ultimately shaped the brand’s foundation.

Drink Rmbr started the most honest way possible: homebrewing kombucha in a closet during COVID. From there, Jack did something more founders should talk about. Instead of jumping straight into a co-packer, he volunteered at a local kombucha company, eventually becoming their head brewer. That hands-on experience gave him deep operational fluency and helped him avoid costly mistakes later.

The early days were scrappy. Shared kitchens. Small batch runs. Five-gallon kegs hauled into a friend’s co-packing facility. That path led Drink Rmbr to become one of the first kombucha brands in Chicago to scale in cans instead of glass, helping modernize how kombucha is perceived and consumed

One of the biggest challenges came when outsourcing manufacturing. Jack emphasized how critical contracts, inventory ownership, and clear operational responsibilities are when transitioning to co-packers. His advice is blunt: talk to operators who have done it before, or bring in a consultant early to avoid painful churn.

On the growth side, Drink Rmbr took an unconventional route. Instead of chasing retail first, they focused on food service, cafes, restaurants, and office distribution. Offices became a powerful channel, putting product directly into the hands of consumers with disposable income and driving organic pull-through to retail.

That strategy helped unlock their first major retail win, landing in Mariano’s through a local pitch competition. From there, the focus has shifted toward natural grocery, where the core customer already shops and velocity matters more than store count.

Jack’s advice for aspiring CPG founders is simple but hard-earned: invest early in building a clear brand universe. Know who your customer is, what your brand stands for, and what lifestyle you’re inviting people into. Skipping that work early often leads to expensive rebrands later.

Drink Rmbr is still early, but the foundation is strong. Intentional growth. Operational fluency. Community-first thinking. This is what modern beverage brands are starting to look like.

News:

Brand Launches & Retail Expansion

DropOut Companies launches Bronco: Bronco, the second national brand from DropOut Companies following Jams, has officially rolled out a high-protein frozen breakfast bagel sandwich lineup nationwide with exclusive endcap placement at Target. Products include Turkey Sausage, Egg & Cheese and Turkey Bacon, Egg & Cheese formats, positioned as a modern take on classic breakfast with high protein and cleaner ingredients. This marks DropOut’s second big brand rollout in six months.

Korean-Bros goes live — A new brand/website korean-bros.com launched on January 1, 2026, entering the Korean-inspired CPG space. Launched by influencer James Seo.

New placements at Target — Kindling, a better-for-you pretzel brand, launched nationwide at Target as of December 28, 2025, joining First Day’s nationwide Target rollout with dedicated endcaps. Together, these launches highlight continued big-box traction for emerging CPG brands across snacks and functional nutrition.

Loopini launches at Whole Foods Market — Loopini, the high-protein frozen pizza brand, has officially launched at Whole Foods Market, rolling out across the Northeast and North Atlantic regions. The milestone marks a full-circle moment for a brand that was built through firsthand customer research in the frozen aisle and highlights continued demand for better-for-you frozen innovation.

Product Expansions

Sleep or Die launches Sleep Strips — Sleep-focused wellness brand Sleep or Die unveiled Sleep Strips, a new strip-based format designed to support rest and recovery, signaling continued experimentation with convenience-first delivery formats in the sleep category.

Barebells expands beverage portfolio — After entering protein soda in October 2025, Barebells is continuing its push into beverages with a renewed focus on ready-to-drink protein milk, expanding its flavored milk drink lineup as it leans further into convenient, high-protein formats beyond bars.

GORGIE enters protein energy — GORGIE has launched its first Protein Energy drink, combining 8g protein with green tea caffeine, biotin, and B vitamins for sustained, jitter-free energy. The move marks a clean expansion into protein-forward energy, now rolling out at Target alongside existing distribution at Whole Foods, Sprouts, and Amazon.

The Coconut Cult debuts 4 oz probiotic yogurt — A smaller 4 oz format aims to broaden accessibility and trial for its probiotic yogurt cup offerings.

Bloom Nutrition clear protein line — New clear protein SKUs launched in Raspberry Lemon and Strawberry Watermelon flavors.

Mid-Day Squares launches first non-chocolate product — The brand introduced its No Bread PB&J, signaling diversification beyond chocolate bars.

David launches Bronze line — David Protein is kicking off 2026 with Bronze, a new everyday protein bar line positioned as a more accessible, lower-intensity option within the brand’s lineup. Bronze maintains David’s high-protein, low-sugar focus while targeting broader daily consumption, expanding the brand beyond its core performance bars.

Cymbiotika adds Liposomal Advanced Creatine — A new product offering focused on performance supplement space as the year begins.

Non-alcoholic and wellness launches

White Claw N/A beverage — White Claw enters the non-alcoholic segment with a new N/A drink.

Mel Robbins launches protein shot brand Pure Genius — Bestselling author and podcaster Mel Robbins debuted a protein shot line, expanding her footprint in the functional consumables space.

Funding & Investment News

NextFoods Inc secures fresh $10M funding — NextFoods, parent of functional nutrition brands GoodBelly and Cheribundi, closed a $10 million Series 3 round led by ECP Growth to accelerate innovation across gut health, recovery, and sleep categories, and expand distribution and marketing nationwide.

Swishables seed funding — On-the-go oral care brand Swishables raised nearly seven figures in seed capital from investors including Jason Cohen, Nik Sharma, Ben Soffer, and Claudia Oshry.

Healthy Waffle Maker EVERGREEN raises $15.2M — Evergreen secured $15.2M in fresh equity funding.

M&A & Strategic Moves

Jason Kelce invests in Hank Sauce — Former NFL center Jason Kelce made a strategic equity investment in New Jersey hot sauce brand Hank Sauce through his private family office, aiming to support national expansion, brand visibility, and content collaboration.

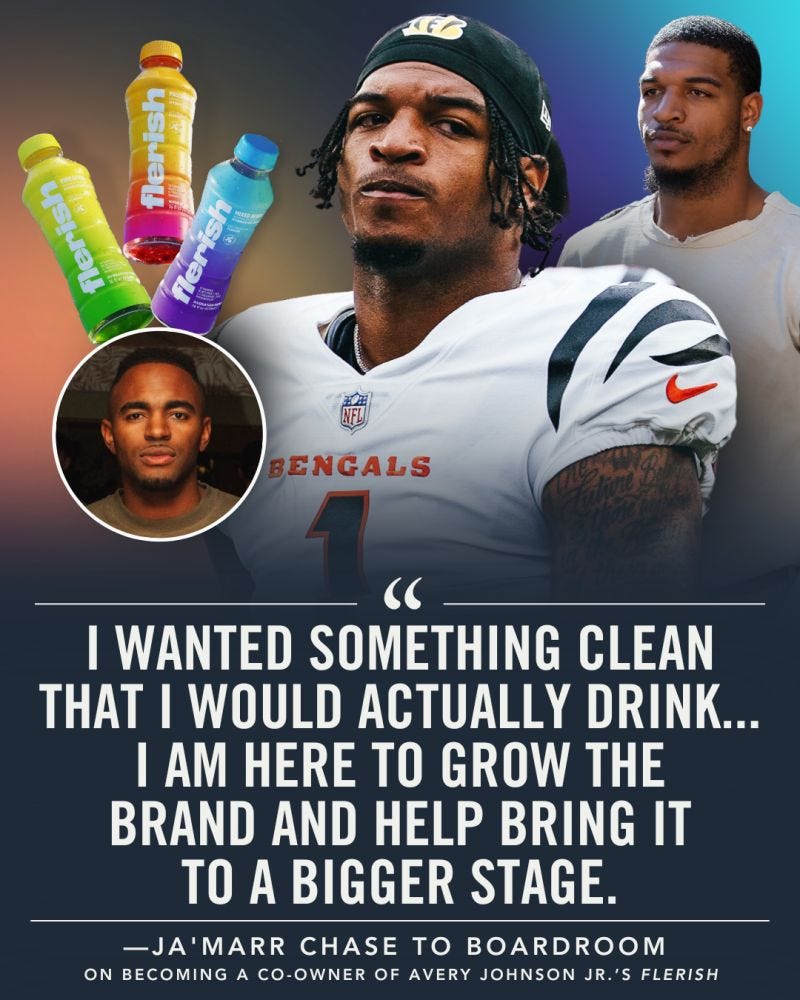

NFL WR Ja’Marr Chase joins Flerish Hydration — Bengals star Ja’Marr Chase took an ownership stake and partnership role with performance-first hydration brand Flerish, aligning athlete ownership with a clean hydration platform rather than just a promotional deal.

Jim Murray launching Anomaly — Jim Murray, former President of RXBAR and co-founder of Feastables, is entering the health and wellness supplement space with a new brand called Anomaly focused on daily immunity or preventative wellness formulations.

Beauty & CPG M&A

Kiss Beauty Group acquires Chillhouse — Kiss Beauty Group, a leader in mass-market nail and lash categories, has acquired Chillhouse (terms undisclosed), expanding its footprint in beauty wellness and lifestyle CPG.

Vacation explores minority stake sale — According to Beauty Independent, lifestyle brand Vacation has enlisted Raymond James to explore a minority stake sale.

Sauz influencer-led cap table play — Sauz brought on a slate of influencers as strategic investors as Bulletpitch’s first food investment, signaling a creator-centric funding model in CPG.

Squared Circles preparing Amulet launch — The L Catterton-backed venture incubator Squared Circles is planning the launch of Amulet in 2026, pointing to incubator-to-brand development strategies.

Whether you’re launching your first SKU, pushing into retail, or just trying to stay ahead of where CPG is headed, that’s what Cpgconnect is here for. This community exists to connect the right people, surface real opportunities, and share what’s actually working as brands scale.

If you haven’t yet, take a minute to fill out the form so I can keep tailoring this to what’s most useful for you. And for daily updates, brand finds, and behind-the-scenes CPG moments, make sure to follow along on Instagram.

→ Follow @cpgconnect.xyz

More coming soon. Appreciate you all and excited for what 2026 has in store.

Catch you next week ✌️

- Zach

P.S. If this was helpful, pass it along to a founder or teammate who’d get value out of it. And as always, hit reply anytime. I read every message.