Cpgconnect // Vol. 14: Smucker’s Protein PB&J, Little Spoon x Target & Junkless Goes Protein

Protein arms race, Target’s biggest food launch ever, and a clean-label bar brand going big.

From Smucker’s finally adding protein to Uncrustables, to Little Spoon taking over six aisles at Target, to Junkless stepping into the protein bar ring, this week is all about category expansion and legacy vs. challenger plays. Add in a fresh hydration x beauty crossover and an NBA-backed protein soda, and you’ve got a snapshot of how fast functional CPG is moving.

No events coming up with BFCM coming up : ( (If you have any, feel free to send em my way!)

Btw, if you didn’t already know, at Lunar Solar Group, we help CPG brands grow through paid media, lifecycle (email/SMS), creative, and web/CRO, working with names like Vita Coco, Olipop, Liquid Death, Ritual, Magic Spoon, Daily Harvest, Truff, Honey Mama’s, Chomps, and more.

As we head into Black Friday / Cyber Monday, we’re offering a free Klaviyo or Meta audit for any 8-Figure brand. If you want a second set of eyes on your flows or campaigns to make sure everything’s dialed in before the holiday rush, give us a shout - happy to dive in with you.

Also, it’s my B-DAY today!! Literally would make my day if you could just share this w/ a cpg friend of yours ;)

Now let’s get into it…

Friend Shoutout: Nicolas Figari and the team at Parrot. A growth-focused marketing agency working directly with startup CPG brands on paid media, organic growth, and bold design. Nicolas has scaled an agency to $5M+ revenue and consulted for Fortune 500s, but Parrot’s sweet spot is helping hungry young brands build the foundation to hit 7-figures. From paid to creative to strategy, he knows his stuff.

Let me know if you want an intro or more info!

Brand Shoutout: drinkprox.com - Prox is a hybrid functional beverage that combines 20g protein, natural caffeine, and collagen in a 90-calorie, zero-sugar can positioned as “better than a shake, smarter than an energy drink.”

Unwrapped w/ Jess from Open Late Collective

What was the moment you realized customer experience & retention should be the lens through which you publicly critique the industry?

I didn’t have one neat “lightbulb moment.” It was more of a throughline across my entire career. Feastables was my fifth startup, but I’ve been in CX and product marketing for nearly 20 years. No matter the role, I kept coming back to the same question: how does the way a brand interacts with its customers shape behavior, build loyalty, and drive adoption?

When I founded Open Late Collective, a CX & Retention marketing studio, I leaned into that. Instead of critiquing through acquisition or growth hacks, I chose CX and retention because they reveal the truth, whether a brand’s promises line up with reality and whether customers care enough to come back.

In your CX and retention work you see what resonates (or doesn’t) at scale. What’s one CPG or retention trend you believe is officially dead?

If I had to call time of death on something, it’s the idea that a one-off discount or gimmick can build loyalty. For years, brands leaned on “surprise and delight” coupons, holiday flash sales, or random giveaways as if those tactics alone would keep customers coming back. The truth is, consumers are too savvy for that now.

A discount might get you the second order, but it won’t get you the fifth. What actually resonates is when CX and retention are built around consistency and behavior. Customers want to feel understood. They want friction removed, their preferences remembered, and their time respected.

Having built customer journeys end-to-end, what’s one critical decision founders consistently misjudge when scaling a brand with profitability in mind?

One of the biggest misjudgments I see is treating customer experience and retention as expenses instead of revenue drivers. When founders are scaling, they focus heavily on acquisition and margin math, and both CX and retention get deprioritized.

On paper, it looks like protecting profitability. In reality, it erodes it. Profitability at scale comes from repeat purchases, higher LTV, and lower churn. Retention work, from post-purchase education to thoughtful replenishment and loyalty loops - is what actually turns acquisition dollars into sustainable revenue.

From your vantage in CX, what recent retail or format launch impressed you, not because of the product itself, but because of how seamlessly it delivered to and engaged customers?

What’s on my mind today is Starbucks’ new protein launch with cold foam and lattes. What stands out to me isn’t the product itself, but how they tried to fold it into existing customer rituals.

They didn’t launch a separate protein line. They built it straight into what people already order every day. The protein-boosted milk option is smart because it turns any latte into a protein drink, which deepens customization and makes it feel natural instead of gimmicky.

The tension is that early feedback is mixed. Some customers are saying it tastes chalky. That’s the risk when you try to add functional upgrades into a lifestyle ritual. If execution misses, it erodes trust. If it works, it strengthens loyalty.

As someone who’s both built and now advises brands via Open Late, what’s the one KPI or signal in retention/CX you’re watching in new brands today that tells you they might break out?

The signal I pay the most attention to is repeat purchase velocity. Not just if customers come back, but how quickly they come back and what triggers that behavior.

If a brand can get a second order within 30 to 45 days without throwing out heavy discounts, that’s a strong early indicator they’re building real adoption instead of just buying growth.

I also look closely at qualitative signals inside CX. Are customers writing in because they’re confused or frustrated, or are they engaging because they want more ways to use the product and be part of the brand? That shift in tone tells you whether you’re building a customer base or a community.

If you weren’t working in CX and brand-building right now, what industry or role would you secretly want to explore?

If I wasn’t working in CX and brand building, I’d be a music video director. There’s something about storytelling through visuals, pulling emotion out of three minutes, and creating a world people want to step into that feels really close to what I do now.

But alas… I’m a CPG slut ¯\(ツ)/¯.

What’s one CPG buzzword you’re officially retiring?

“Community.” Not because community isn’t valuable, but because it’s turned into a lazy buzzword.Most underrated growth lever in Consumer Brands?

Onboarding. Most brands obsess over the first purchase, then leave customers to figure it out.Retail activation done right = ______.

A moment so good people pull out their phones.If you launched a brand tomorrow, you’d ignore ______.

The aesthetic trap. Too many founders waste time on packaging and grids before nailing retention loops.

About Open Late Collective

Open Late Collective is a CX & Retention marketing studio for brands that want staying power. They don’t just fix churn—they design experiences that keep customers hooked and coming back for more.

Because brand building doesn’t sleep.

News:

Smucker’s is putting protein in your PB&J.

The company just launched a high-protein Uncrustables line with 12g of protein per sandwich and two new flavors: Bright-Eyed Berry and Up & Apple.

It’s the first real innovation in the Uncrustables lineup in years — and comes as the protein craze takes over everything from cereal to soda.

Why it matters: challenger brand Jams hit Walmart earlier this year with its own clean-label, protein-packed PB&Js. A few months later, Smucker’s responds. Legacy brands often wait until the pressure is real to innovate, but when they move, they can move fast — and with distribution muscle that’s hard to beat.

The question now: does Jams carve out a niche with its clean-label edge, or does Smucker’s scale and name recognition crush the competition? Either way, we’re officially in a protein PB&J arms race.

Little Spoon just made history.

After 7 years as the #1 DTC baby + kids food brand, they’re officially hitting shelves — and doing it big. On Sept 30, Little Spoon launched exclusively at Target in what’s being called the retailer’s largest food & beverage launch ever.

Six aisles. Seven categories. 20+ products.

Target shoppers will even get first access to a brand-new frozen line — Super Chicken Dippers (the only patented nugget in the aisle, made without seed oils), Chicken Veggie Sliders, and Mini Turkey Kale Meatballs.

And they’re keeping their clean-label edge: every product tested for 500+ toxins, meeting EU standards. In a category where only 9% of parents report confidence in baby food brands, that’s a big differentiator.

Why it matters: Little Spoon feeds 3% of U.S. babies and 80% of their customers are already Target shoppers. This move feels like a natural extension — taking a trusted DTC brand and meeting parents right where they shop.

Legacy baby food brands should be watching closely.

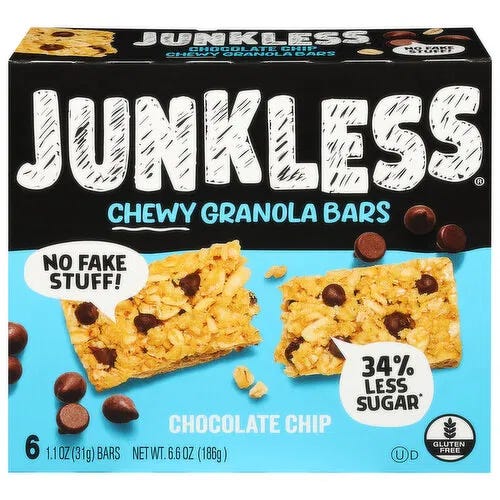

Junkless just leveled up.

Known for their clean-label chewy granola bars, the brand is expanding into protein bars — each packing 15g of protein and 6–8g of fiber with just 3–5g of sugar. Flavors hit that “dessert-inspired” lane: Chocolate PB, Cookie Dough, Birthday Cake, and Cookies & Cream.

Distribution is starting at Sprouts with an Amazon rollout coming soon.

This move comes less than two years after Mike Repole (Vitaminwater, BodyArmor, Pirate’s Booty) acquired a majority stake in Junkless through his Impact Capital arm. With Repole’s track record of scaling brands into billion-dollar exits, the protein bar launch feels like a natural next chapter.

Why it matters: Protein is having a cultural moment — from cereal to PB&Js — and Junkless is planting a flag in a category that blends functional nutrition with indulgence. Backed by Repole, they’ve got the capital and playbook to chase serious scale.

Question is: can Junkless break through in a protein bar market crowded with giants like Quest, RX, and ONE — or will their clean-label angle carve out something new?

Don’t Quit just added Russell Westbrook to the cap table.

The protein beverage brand — already backed by L Catterton, Sweetwater Private Equity, Keurig Dr Pepper, and L.A. Libations — now brings on the NBA star as an investor, adding athlete credibility to its growth story.

Don’t Quit started with clean-label protein shakes but is now betting big on protein soda — sugar-free, carbonated, and patent-protected — launching in major retailers this year. They’re also in the middle of a $15M raise to fuel scale.

Why it matters: Between strong PE backing, strategic partners like KDP, and now Westbrook’s cultural pull, Don’t Quit is positioning itself as a challenger brand in the fast-emerging functional protein beverage space.

The question: can protein soda break through and become the next big performance category — or is it still too early for consumers?

SlowMornings is bringing beauty to hydration.

The new brand positions itself as a beauty-focused electrolyte play, launching with a debut line that pairs collagen peptides, biotin, magnesium, potassium, and French sea salt. The promise: hydration that also delivers a “glow.”

It’s a smart wedge into two fast-growing categories — hydration mixes and beauty-from-within supplements — by combining them in a single product. Think Liquid I.V. meets Vital Proteins, wrapped in beauty-centric branding.

Why it matters: Functional hydration is crowded, but SlowMornings is betting that the beauty-first angle will resonate with women who already invest in skin care and wellness. Backed by consumer insights from 500+ women, the brand is leaning into that “hydrate & glow” positioning to carve out its lane.

The question: can SlowMornings break through in a sea of hydration brands by owning beauty, or will it get lost in the noise of electrolyte powders and collagen supplements?

That’s it for this week.

Whether you’re launching your first SKU, scaling into Whole Foods, or trying to stay ahead of what’s breaking through, CPG Connect is here to help you keep pace.

See you next week✌️

— Zach

P.S. If this was helpful, feel free to pass it along to a friend, teammate, or founder in your orbit. And hit reply anytime, I read every note.

JESSSSSSSS big fan